Previously, merchants were limited to selling their products in person. This was inconvenient and posed security risks. However, the advent of e-commerce has changed this landscape.

E-commerce has grown significantly, enabling businesses to sell without physical stores. In Nigeria, sellers and customers alike find this virtual approach convenient.

Yet, e-commerce isn’t devoid of risks, including cybercrimes. Trusting online stores and payment gateways can be challenging, especially with rising fraud. Flutterwave reviews entered the scene, providing Nigerians with a secure payment solution. This simplifies online transactions, addressing previous difficulties with platforms like PayPal. This article delves into Flutterwave reviews‘ role as a trusted fintech platform.

What Is Flutterwave?

Flutterwave is a fintech firm established in 2016, dedicated to providing financial solutions that streamline payment processes for global clients of businesses. While its primary focus lies within Africa (operating across more than 11 African countries), the company’s headquarters are situated in San Francisco, California. There’s potential for future expansion to additional continents.

How Does Flutterwave Function?

To begin with, flutterwave login serves as a platform for both sending and receiving funds. The website incorporates a sales mode feature, enabling you to gather payments from customers across the globe. This means you can accept payments in various currencies. Upon registering an account with flutterwave login, you gain the ability to generate a payment link. This link can be easily shared with your clients or contacts who intend to pay for your services or contribute donations. You can even distribute this link through your social media profiles.

Furthermore, whether you’re an individual, a registered business entity, an NGO, or an event management company, Flutterwave equips you with essential tools to enhance your business. These tools collectively constitute the diverse functionalities of the Flutterwave platform.

Various Functions Offered by Flutterwave

Flutterwave offers a diverse array of functions tailored to businesses’ needs. Below is a comprehensive list detailing the wide range of capabilities provided by Flutterwave:

- Payment Solutions: Designed to ensure optimal payment experiences for your clientele. This feature enables seamless receipt of funds from across the globe and facilitates single or bulk transfers to other accounts. An added advantage is the ability to accept payments in over 150 different currencies.

- eCommerce Tools: This encompasses the creation of complimentary online stores, the generation of professional invoices, and the establishment of payment links.

- FaaS (Financial Services as a Service): Embed financial services directly into your products to enhance their value and utility.

- Virtual Cards: Facilitates the issuance of both physical and virtual cards, expanding payment options for your customers.

- Capital Services: Provides expedited access to flexible loans, empowering you to nurture and expand your business endeavors.

- Business Registration: Streamlines the process of registering and incorporating your business, regardless of your location.

Understanding the multifaceted functions that Flutterwave offers and its pivotal role in bolstering businesses, you might be contemplating the initiation of an account. In this regard, we find it imperative to guide you through a step-by-step procedure for creating and verifying your Flutterwave account.

How to Create and Verify a Flutterwave Account

After grasping the fundamentals of Flutterwave, here’s a step-by-step guide on how to establish your account with Flutterwave:

- Access the Flutterwave Website:

- Navigate to the Flutterwave website and locate the account creation section.

- Fill in all the required details as displayed in the accompanying image.

- Click on “Get Started” to initiate the account creation process.

- Confirm Your Email:

- Check your email inbox for a message from Flutterwave.

- Click the provided link in the email to confirm your email address.

- This link will redirect you to your newly created Flutterwave account.

- Specify Your Account Purpose:

- Within your account dashboard, select the purpose for using Flutterwave.

- This choice assists in tailoring the platform’s tools to your needs.

- If your business isn’t registered yet, opt for the “Individual” option.

- Complete Your Account Information:

- The dashboard is divided into three sections: Bank Account, Merchant Information, and Document Upload.

- Fill in the requested information accurately in each section.

- Ensure the accuracy of your information before saving it.

Note: If you get logged out during this process, don’t worry. Simply log in again and click on “Get Started” or navigate to “Settings” >> “Business Preference” to resume where you left off.

- Initiate Verification:

- Click on “Start Session” to begin the verification process.

- Follow the prompts to capture clear images of both sides of your ID card and a selfie.

- If done correctly, proceed by clicking “Continue.”

- Review and Approval:

- Once you’ve completed the verification process, your account will be under review.

- You will receive an email notification upon approval.

- The verification process typically takes around 30 minutes.

Congratulations! You’ve successfully created your flutterwave reviews account. Next, you can explore how to receive payments using your newly established account. To access your account and start the process, visit the account creation page and follow the aforementioned steps.

Receiving Payments through Flutterwave (Domestic and International):

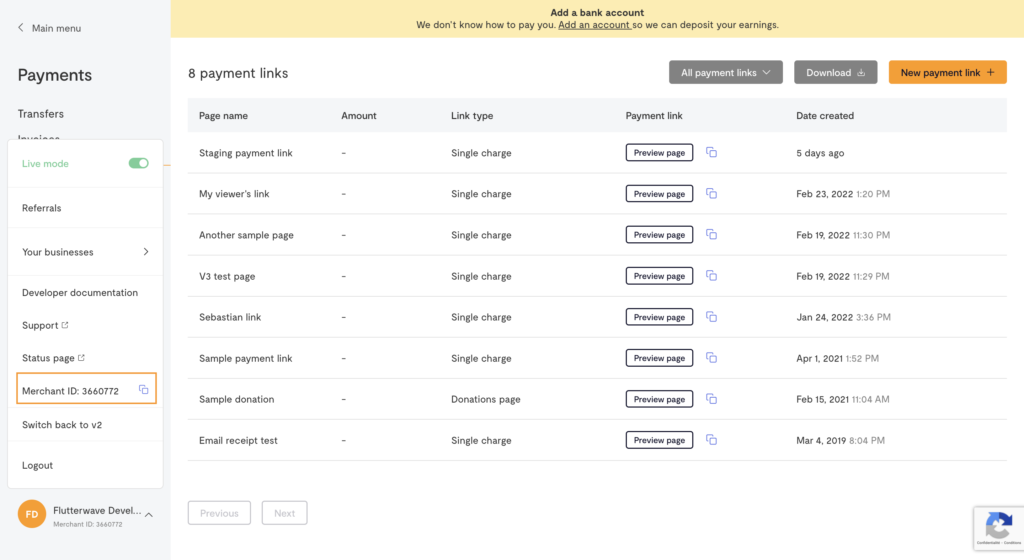

To efficiently collect local and international payments using flutterwave reviews , you must initiate the creation of a payment link. As previously mentioned, this payment link can be easily shared with individuals or entities from which you are anticipating payments. You can even incorporate it into your social media bio to facilitate purchases from potential customers. Generating a payment link is a straightforward process; adhere to the ensuing steps.

How to Create a Flutterwave Payment Link

- Access your Flutterwave dashboard and navigate to the Payment Links section.

- Choose the > “Create Payment Link” option.

- For single payments, opt for > “Single Charge.” Alternatively, if dealing with a payment plan, select > “Recurring Charge.”

- Furnish the payment specifics. If you desire to grant your customers the liberty to determine the payment amount, leave the > “Amount” field blank. Conversely, if a specific sum is required, input the relevant amount.

- Subsequently, select > “Create Link” to instantiate the creation of your payment link leading to the payment page.

Steps to Withdraw Funds from Flutterwave

To initiate a withdrawal from your Flutterwave account, follow these steps:

- Log in to your dashboard.

- Click on the >Transfer option.

- Choose >New transfer from the available options.

- Pick the desired currency for the transfer and input the amount.

- Provide the necessary details for a new account or select a recipient from your existing list.

- Click on the >Proceed tab to finalize and complete the transfer.

What’s More to the Allegations In Flutterwave Scandal?

While the aforementioned accusations are sufficient to cast a shadow over Agboola and the lofty $3 billion valuation of Flutterwave, the narrative goes even deeper. Additional aspects emerge in this tale. Allegedly, the CEO maintained a dual employment status, simultaneously serving at Flutterwave and retaining a full-time role with his prior employer, Access Bank, all while keeping this arrangement undisclosed. Claims suggest that he exploited his position and accessible resources from the bank. This account, as presented by David, is not the extent of it. The story also implies his involvement in amorous relationships with female subordinates at Flutterwave.

What Caused the Flutterwave Scandal Outbreak?

The origin of the Flutterwave scandal can be traced back to a revealing post on Medium by Clara Wanjiku Odero, the former head of implementation at Flutterwave. Her article ignited the entire scandal, as she detailed her allegations of harassment by the company’s CEO and her struggle to receive her rightful dues upon leaving the organization. Furthermore, she asserted that the company’s negligence resulted in her being subjected to an investigation by the Kenyan police.

Odero’s accusations prompted a multi-faceted investigation that unearthed numerous questionable practices and cultural aspects within Flutterwave. To corroborate her claims, Odero collaborated with Rest of World, which then interviewed a dozen former employees of Flutterwave, all of whom substantiated the revelations she made. According to these ex-employees, Odero’s allegations largely echoed persisting issues within the company.

These former staff members also disclosed that the company had fostered an environment of bullying and inappropriate relationships between supervisors and subordinates. Moreover, departing employees consistently experienced underpayment for their stock options, and deliberate administrative errors were allegedly embedded within company documentation, leading to legal predicaments for those leaving the organization. Fearing potential consequences, these individuals opted for anonymity, underscoring the pressure and toxicity they encountered during and after their tenure at the company.

In response to the flurry of allegations and disclosures from former staff, a representative from Flutterwave reached out to Rest of World via email, vehemently refuting the claims made against the company. The spokesperson denounced most of the allegations as fabricated falsehoods, recycled issues, or matters that had already been resolved by the company. Additionally, the spokesperson emphasized that Flutterwave adheres to robust HR policies that continually develop to ensure fairness and justice throughout all levels of the workforce.”

Conclusion

I trust this article has comprehensively and succinctly elucidated all the essential information about the functioning of Flutterwave. Consider initiating a Flutterwave account today to delve into a plethora of business prospects. It’s crucial to note that registering with Flutterwave assures you a versatile payment solution catering to both local and international needs.

FAQs

Response Time of Flutterwave Customer Care

Flutterwave operates from Monday to Friday, 8 a.m. to 5 p.m. Within these hours, their helplines are operational, allowing you to promptly reach out for any queries. For a swifter response, it’s advisable to send them an email during their regular working hours.

Have You Created Your Flutterwave Account?

Now that you possess a comprehensive understanding of its operations, seize the opportunity by clicking the following link to establish your Flutterwave account. Unlock limitless business possibilities today.